Yes, vehicle repossession debt can lead to bankruptcy if it creates an overwhelming financial burden. Here’s how: Deficiency Balance – If your car is repossessed and sold at auction for less than what you owe on the loan, the lender can pursue you for the remaining balance (deficiency balance). This can be a significant debt, […]

read more

Credit counseling is a useful tool for many people struggling with debt, but it is not always the best solution. It may not help if your debt is too large to be repaid within a reasonable time, your income is insufficient to cover even reduced payments, or your financial hardship is long-term and unlikely to […]

READ MORE

You do not have to file bankruptcy with your spouse. You have the option to file: Individually – If most of the debt is in your name, filing alone may be a better choice. This can protect your spouse’s credit if they are not legally responsible for the debts. Jointly – If both you and […]

read more

When you take a step back and really evaluate your financial situation, you may be shocked at just how much debt is truly costing you. Many people continue making minimum payments, struggling to keep up, and watching their balances barely decrease due to interest, fees, and penalties. But what if there was a way to […]

READ MORE

In a bankruptcy case, certain actions can be considered fraudulent, which could result in serious consequences like the denial of a discharge, fines, or even criminal charges. Here are some common mistakes that could be viewed as fraud by a bankruptcy court: 1. Incurring Debt with No Intention to Repay Recent Credit Card Usage: Making […]

read more

Yes, it is possible to move into an apartment with bankruptcies on your credit, though it may be more challenging. Landlords often check credit reports during the rental application process, and a bankruptcy can raise concerns about your ability to pay rent consistently. However, there are several strategies you can use to improve your chances […]

READ MORE

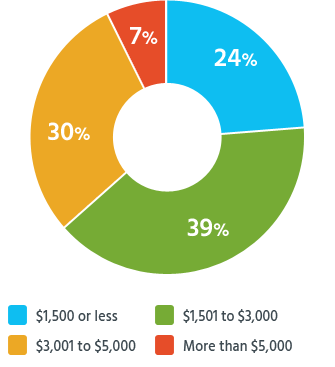

When you really look at your debts, its much cheaper to pay a Bankruptcy Attorney a flat one-time fee VS paying all your creditors over time. Additionally, if you don’t file, you face the risk of being sued and having to defend your case in a civil court, your wages being garnished at up to […]

read more

Before filing for bankruptcy, there are several actions you should avoid to prevent complications or potential allegations of fraud. Here are some key things to avoid: 1. Incurring New Debt Credit Card Charges: Making large purchases or taking out cash advances on credit cards right before filing can be seen as fraudulent. Creditors may argue […]

READ MORE

Taking out large cash loans or incurring significant debts right before filing for bankruptcy can be seen as fraudulent behavior. This is because the bankruptcy court may interpret it as an attempt to discharge debts you never intended to repay. If the court determines that you took out a loan with the intention of filing […]

read more

Yes, most of your credit cards will likely become null and void after you file for bankruptcy. Here’s how it typically works: 1. Chapter 7 Bankruptcy: Debt Discharge: In Chapter 7 bankruptcy, most of your unsecured debts, including credit card debts, are discharged. This means you are no longer legally obligated to pay those debts. […]

READ MORE

helping good people with bad debt

helping good people with bad debt

Stockton • Elk Grove • Pleasanton • sacramento • los angeles • Surrounding Areas

Connect

Blog

Read the